An innovative cryptocurrency exchange: pioneering features, global reach from China

OKX|Product Analysis (2/100)

1 Product Name

OKX

2 Overview

2.1 One-Line Product Overview

An innovative cryptocurrency exchange: pioneering features, global reach from China

2.2 Basic Product Data

- Registered Users: 50 million(Officially announced 20 million in 2020)

- Market Share: Market share decreased from 18% (January 1, 2022) to 14.7% (December 31, 2022)

- Spot Trading Pairs: Futures Trading Pairs = 831 : 206

- Spot Trading Volume: Futures Trading Volume = 14% : 86%

Data Source:TokenInsight

2.3 Product Financing History

| Time | Event | Amount |

|---|---|---|

| 2013.5 | OKCoin Established | |

| 2013.11 | OKCoin secured angel investment | $1 million |

| 2014 | OKCoin concluded Pre-A round funding | Undisclosed |

| 2014.3 | OKCoin concluded Series A round funding. | $10 million |

| 2017.12 | OKEx closed Series B round funding. | Undisclosed |

3 User Minds

OKX can be likened to the math class representative, possessing not only a solid knowledge foundation but also the ability to approach problems innovatively, offering fresh insights to peers.

User Profile of OKX:

- Active traders: Engaged in derivatives trading, aiming to capitalize on market fluctuations.

- Enthusiastic about novelty and trends: They are constantly monitoring the latest developments, trends, and potential investment opportunities in the cryptocurrency market. They continuously seek new knowledge and insights to maintain a competitive edge in the rapidly changing landscape.

- Tech-savvy: Proficient in using various online platforms and trading interfaces, and may have experience with programming or algorithmic trading.

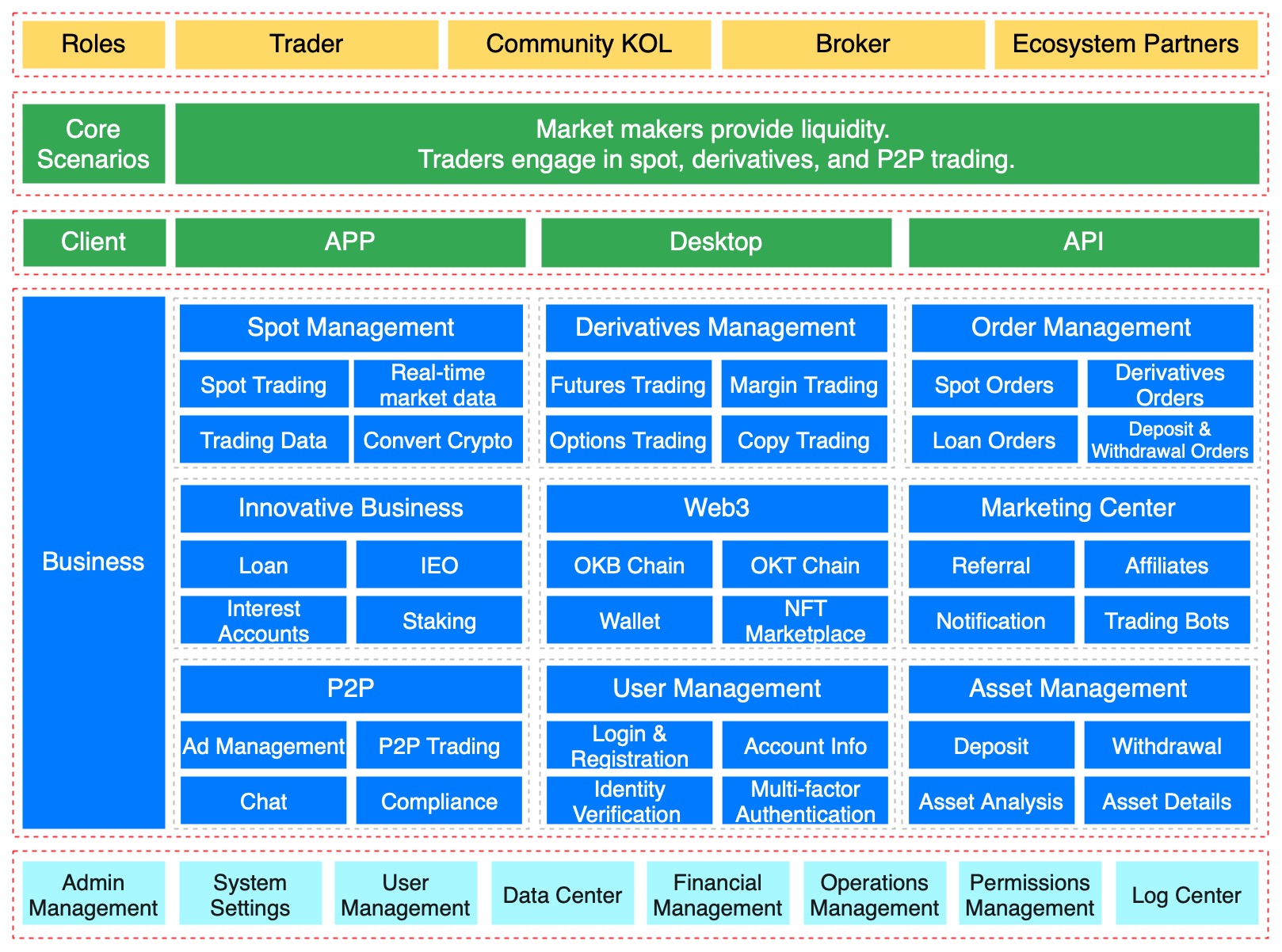

4 Product Architecture

5 Operational System

- 2013-2016: OKCoin established, expanded within China.

- 2017-2018: Emphasized derivatives, expanded internationally, launched OKEx, halted OKCoin operations.

- 2019: Enhanced trading system, introduced Lightning 2.0.

- 2020: Launched Unified Account System, ventured into Web3.

- 2021-2023: Vigorously developed Web3 products, integrated wallet and exchange functions into a single app.

2013-2023 Feature Evolution Highlights:

- 2013

- Platform: Launch of China’s Bitcoin exchange, OKCoin(www.okcoin.cn)

- Trading: Introduction of Litecoin (LTC) trading

- 2014

- Platform: Rollout of OKCoin International site(www.okcoin.com)

- Trading: Implementation of P2P financing, integration of P2P lending with Bitcoin trading.

- Derivatives: Launch of Bitcoin futures contracts, marking early industry adoption.

- 2017

- Platform:

- OKEx founded (originating from OKCoin), registered in Belize

- Revamped OKEx logo design

- OKCoin suspended registrations and RMB deposit services.

- Trading: Launched USDT and BCH markets; introduced C2C trading platform.

- Derivatives: Introduced index trading.

- Platform:

- 2018

- Trading: Introduced OKB trading market; launched Savings feature; implemented algo orders for token trading; introduced “My Wallet”

- Derivatives: Introduced margin trading; launched Perpetual Swap; established position limit rules for futures trading

- Web3 Platform: Issuing OKB tokens

- 2019

- Trading: Introduced Lightning 2.0 trading system.

- Derivatives: Launched BTC/USDT futures trading; Introduced Mark Price System for futures trading; Implemented Tiered Maintenance Margin Ratio System.

- 2020

- Platform:

- Introduced the Morningstar Program, inviting community leaders and KOLs to collaboratively build a blockchain community.

- OKEx’s founder, Star Xu, collaborated with authorities for an investigation, leading to a temporary withdrawal halt (causing panic and USDT price drop to 4).

- Trading:

- Announced the Earn feature; Launched “Convert Small Balances to OKB” product; Introduced “Convert” Function; Launched C2C Loan service.

- Optimized account structure by merging the existing “Staking Account,” “Loan Account,” “P2P Account,” and “Other Accounts” into the “Funding Account”; Initiated public testing of the Unified Account system.

- Derivatives:

- Introduced BTCUSD and ETHUSD options contracts; Launched options contract data analytics; Added Bi-monthly Contracts for Options.

- Implemented Mark Price System for Margin Trading; Introduced real-time settlement function for contracts.

- Web3 Platform:

- Launched the OEC Testnet; Unveiled the OKTC mainnet and issued OKT tokens; Initiated OKB Staking.

- Introduced the Cross-chain Gateway service; Launched Ethereum 2.0 staking service.

- Platform:

- 2021

- Platform:

- OKEx adopts the Chinese name “欧易” and announces its exit from the mainland China market.

- Unveils a $10 million metaverse development initiative.

- Trading: OKEx officially launches the Unified Account system in a grayscale release.

- Derivatives: Introduces portfolio margin mode.

- Web3 Platform:

- Introduces On-chain — a suite of products and services, featuring a decentralized wallet, a robust asset dashboard, a secure NFT marketplace, and user-friendly farming tools.

- Launches an on-chain wallet browser extension.

- Introduces OKExNFT, an NFT trading platform.

- Platform:

- 2022

- Platform:

- OKEx rebranded to OKX

- OKX acquires provisional virtual assets license from Dubai Virtual Assets Regulatory Authority (VARA).

- Releases Proof of Reserves.

- Trading:

- Removes Classic Account V3 API.

- OKX Earn adds a flexible-term loan, Dual Investment, and Smart Gain.

- Derivatives: Launched Margin Asset Borrowing Amount Structure

- Web3 Platform:

- OKX Trade introduces Unoswap and Cross-chain Swaps.

- OKX Wallet adds Yield and integrates Aptos.

- OKX Wallet extension Supports zkSync 2.0 testnet

- Platform:

- 2023

- Platform: OKX established in France; discontinues services in Canada.

- Trading: Introduces Dip Sniper & Peak Sniper; launches Shark Fin; initiates the “Market Maker Program”; upgrades Earn module; implements C2C T+N risk control strategy.

- Web3 Platform:

- OKX Wallet adds Gas Station feature; token market feature; integrates Ledger hardware wallet; simplifies crypto transfers between OKX Wallet and Exchange account; enables crypto purchases with credit cards.

- Launches Cryptopedia

6 Business Model

Spot Trading Fee Revenue (2022.12.1 - 2023.2.28)

$590 million (30% of quarterly spot trading fee revenue allocated for OKB buyback and burn, resulting in the destruction of OKB tokens worth approximately $177 million from December 1, 2022, to February 28, 2023)

6 major profit-making businesses:

- Spot Trading Fees:

- Regular users: Maker 0.08% / Taker 0.1%

- Futures Trading Fees:

- USDS-Margined / COIN-Margined Contracts: Regular users: Maker 0.02% / Taker 0.05%

- Options‘ Trading Fees

- Regular users: Maker 0.02% / Taker 0.03%

- Margin Borrowing Interest:

- Daily Interest Rates: BTC 0.0027%,ETH 0.0027%,USDT 0.0109% (regular users)

- Loans Interest

- Annual Interest Rates: BTC 1%,ETH 1%,USDT 4% (regular users)

- Withdrawal Fees:

- Crypto: determined by blockchain network congestion

7 Distinctive Features

7.1 Account Evolution

OKX pioneered the idea of a Unified Account. After a year of development, the Unified Account system entered public testing in December 2020. Over two years, it underwent thorough exploration and optimization, leading to the retirement of the Classic Account in January 2022. This marked the full adoption of the Unified Account system. This innovation garnered attention and motivated other exchanges to introduce similar Unified Account solutions. OKX’s commitment to innovation has set an industry benchmark.

In June 2022, Binance launched its Portfolio Margin Program, enabling traders to use multiple assets as collateral. This feature is applicable to trading in USDⓈ-M Futures, COIN-M Futures, and Cross Margin Wallets.

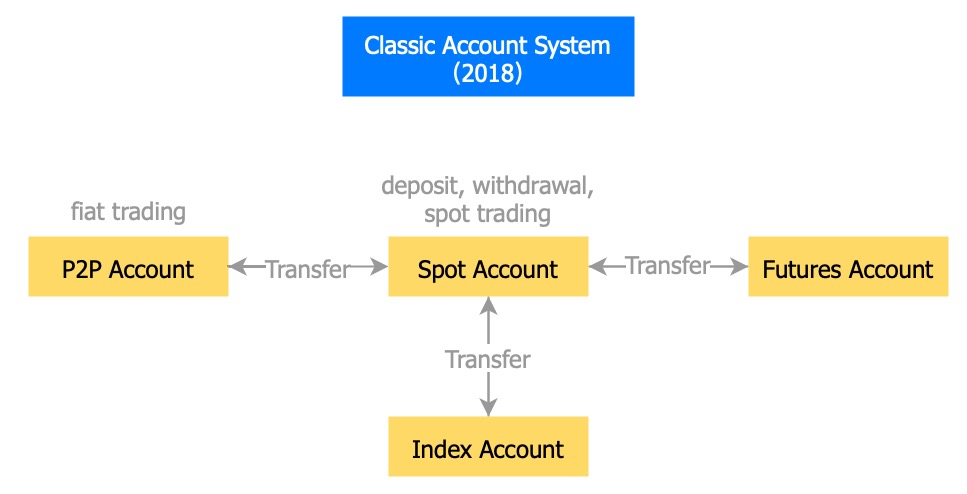

7.1.1 Classic Account System(2018)

In the Classic Account System, accounts are grouped by business type to manage risks and track finances effectively. These categories include Spot, Futures, Index, and P2P Accounts.

- Spot Account: Users shift their crypto from the P2P Account to the Spot Account for “spot trading,” which also enables deposits and withdrawals.

- Futures Account / Index Account: For futures or index trading, users move cryptocurrencies from the Spot Account to the Futures or Index Account.

- P2P Account: Acquired digital assets from fiat transactions are held in this account.

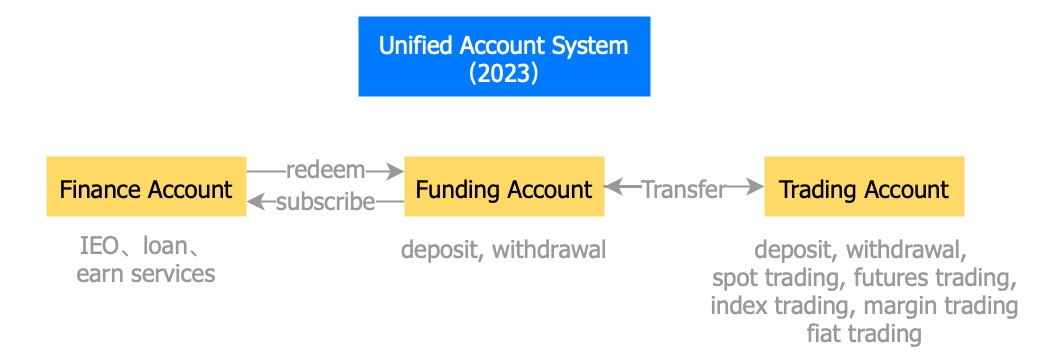

7.1.2 Unified Account System(2023)

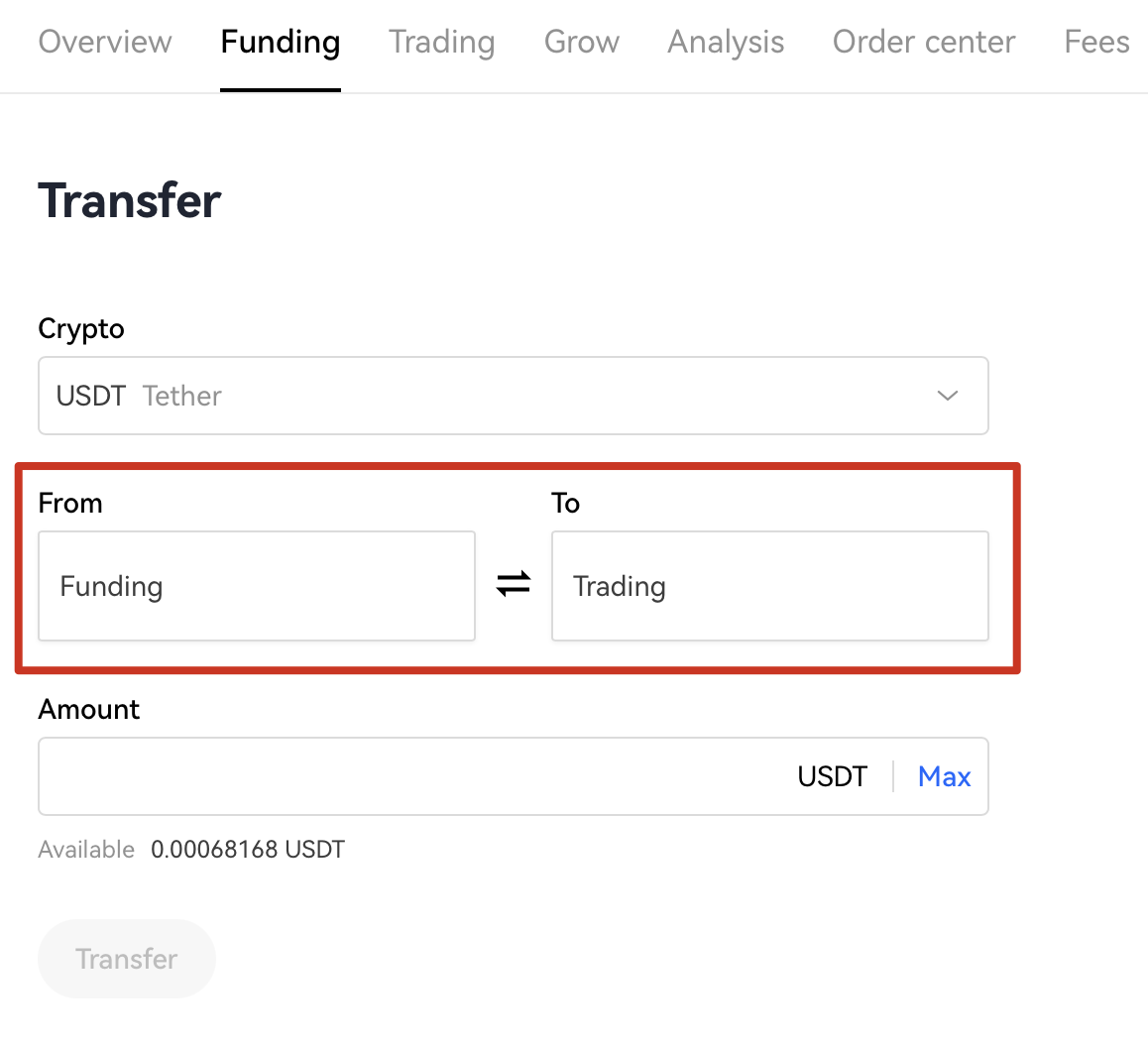

The Unified Account System simplifies user actions, minimizing the need for frequent fund transfers.

Users can conveniently carry out key activities directly within their trading account, including deposits, withdrawals, spot trading, perpetual swaps, futures trading, options trading, margin trading, and fiat trading, offering an all-in-one trading experience.

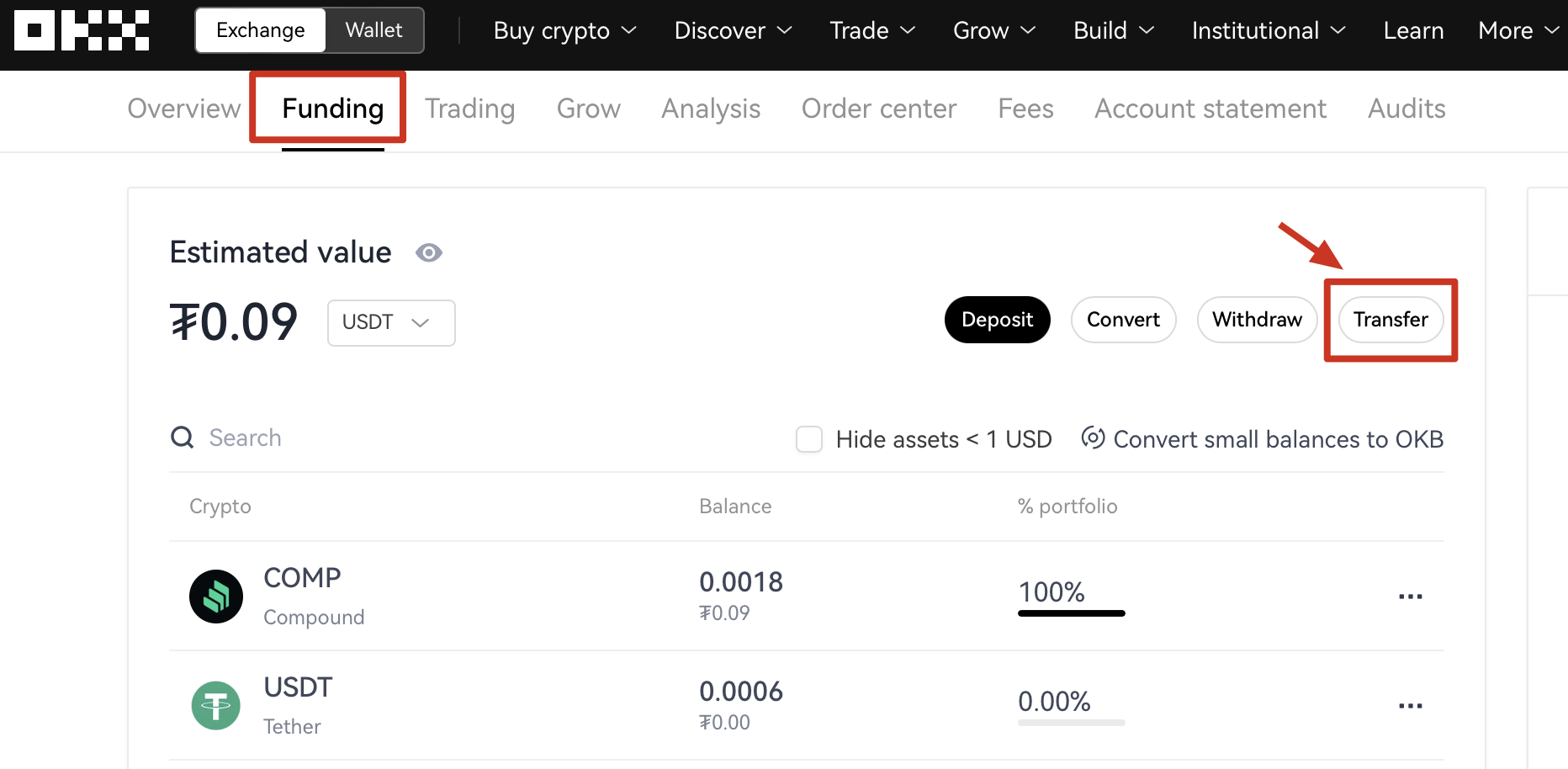

The funding account handles tasks like deposits, withdrawals, IEO participation (Jumpstart), loans, and activities such as savings and staking. This ensures effective fund utilization and secure management.

The introduction of the finance account further enhances the trading environment for users, facilitating their participation in diverse financial activities and elevating the overall platform experience.

7.2 Goals of Account Structure Enhancement

7.2.1 Profit and Loss Offset

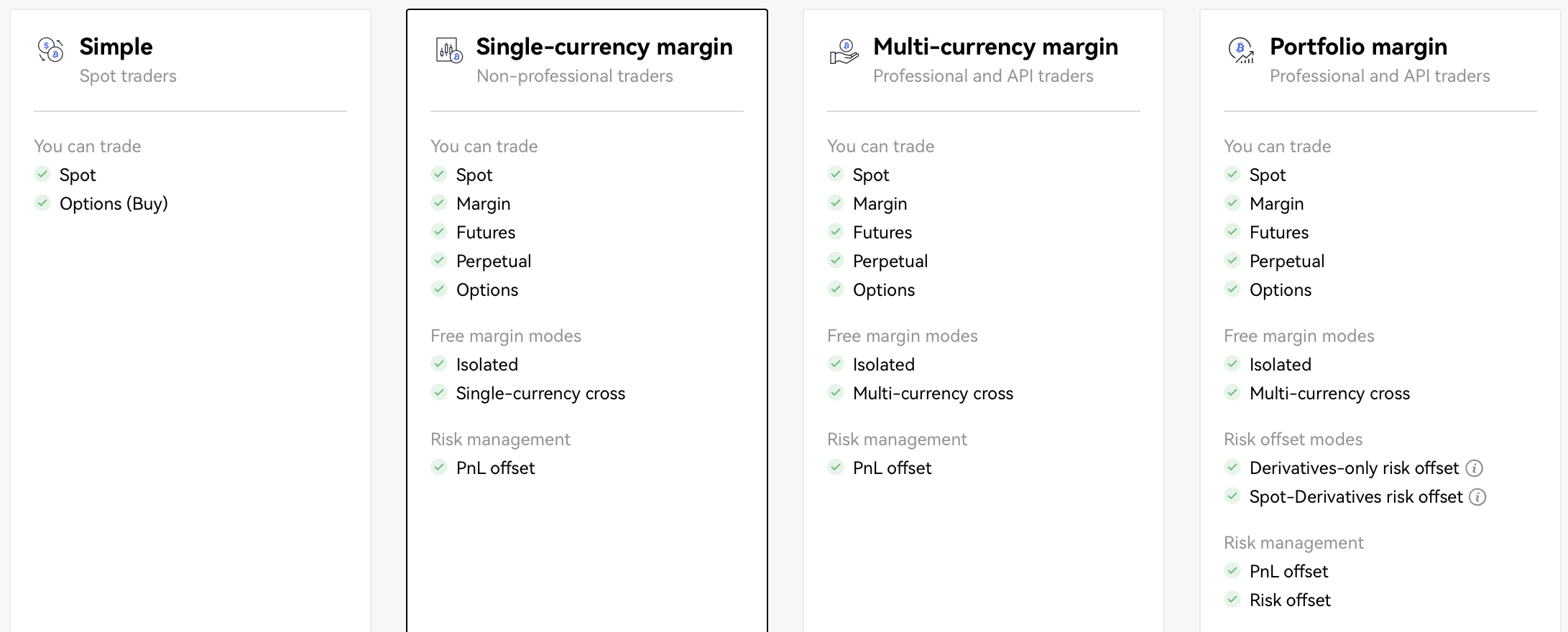

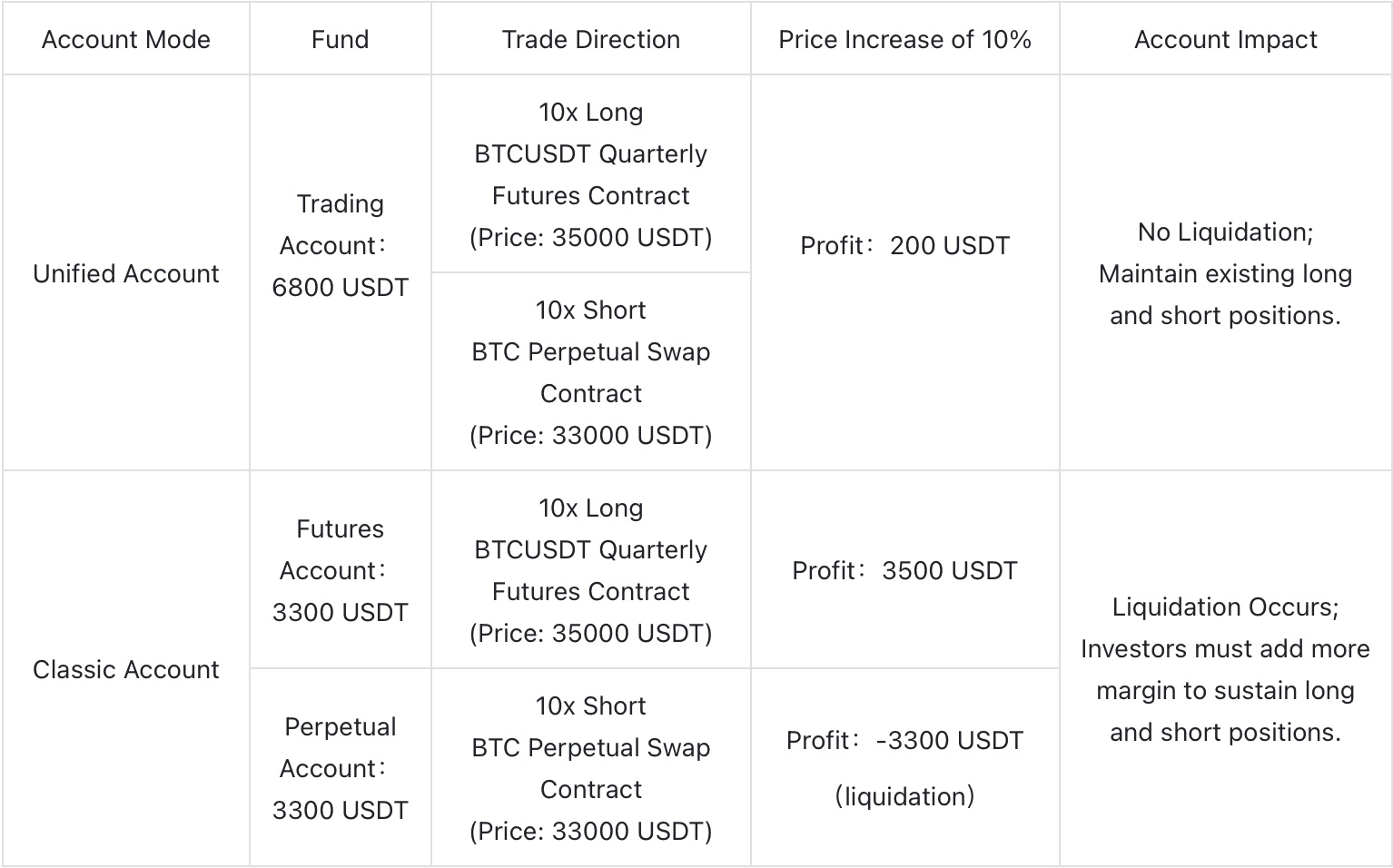

OKX’s Unified Account System has four new account modes: Simple, Single-currency Margin, Multi-currency Margin, and Portfolio Margin. With this innovation, users can trade various digital asset derivatives in one account and share margins between different product lines.

Margin sharing helps lower liquidation risk in volatile markets, strengthening risk resistance. But if liquidation happens, losses could be higher compared to non-shared margins. This follows the “shared glory, shared loss” principle.

Margin Calculation in Single Currency Margin Mode vs. Regular Mode (TokenInsight)

7.2.2 Enhancing User Experience

In the Classic Account, spot trading involves two steps: first, buy cryptocurrencies using the Point-to-Point Account, then transfer to the Spot Account. For futures trading, funds need to be moved again to the Futures Account, making it three steps.

In contrast, the Unified Account streamlines this by enabling direct spot trading after deposit. This removes the need for multiple fund transfers, simplifying the process, enhancing user experience, and boosting trading efficiency. This also reduces the learning curve, making trading easier for more users and promoting growth on OKX.

8 Summary and Insights

- OKX was among the earliest trading platforms to introduce Bitcoin futures right from the start, establishing itself as a pioneer in the realm of futures trading. Through derivative trading, it rapidly expanded its business. In a competitive landscape with Binance, Huobi, and OKX as the major players, OKX stood out with its robust futures liquidity.

- OKX’s innovative approach is also evident in its unique Unified Account. This initiative not only enhances efficient fund utilization and risk management for futures trading but also simplifies user participation, thereby enhancing the overall user experience. This innovation provides users with a more streamlined method of operation and sets a new industry benchmark.

- Another standout feature of OKX is how it combines wallet and exchange functions in one app. This blend allows users to easily manage their assets and conduct trades all in one place, creating a balanced mix of centralization and decentralization. As a result, users have more choices and a more convenient experience.

- A pivotal factor contributing to OKX’s success is its rapid iteration. Following a similar approach to Binance, OKX introduces new app versions weekly, consistently fine-tuning and enhancing the user experience. Even if minor issues arise, OKX responds swiftly, releasing fixes promptly to ensure user security and a smooth experience.

觉得文章不错就支持一下呗~

本文版权归 June 所有,采用 CC BY-NC-ND 4.0 国际许可协议 授权。

非商业转载请注明作者及原文链接,禁止改编及用于商业用途,商业合作请联系:yula.qian@gmail.com