Prioritizing compliance and security, the first cryptocurrency exchange to be listed on Nasdaq.

Coinbase|Product Analysis (3/100)

1 Product Name

Coinbase

2 Overview

2.1 One-Line Product Overview

Prioritizing compliance and security, the first cryptocurrency exchange to be listed on Nasdaq.

2.2 Basic Product Data

- Registered users: 73 million, with 7.4 million monthly active users (as of November 10, 2021)

- Market share: 1.31% (Q1 2023)

- Spot trading pairs: Total of 665, primarily Bitcoin and Ethereum, accounting for around 60%.

- Trading Volume:

- Consumer Trading Volume: $21 billion (Q1 2023), $14 billion (Q2 2023).

- Institutional Trading Volume: $124 billion (Q1 2023), $78 billion (Q2 2023).

- Total Trading Volume: $145 billion (Q1 2023), $92 billion (Q2 2023).

Data Source:TokenInsight

2.3 Product Financing History

| Date | Event | Amount |

|---|---|---|

| 2012 | Establishment | |

| 2012.9 | Angel Round | $600,000 |

| 2013.5 | Series A | $6.11 million |

| 2013.12 | Series B | $25 million |

| 2015.1 | Series C | $75 million |

| 2016.7 | Strategic Investment | $10.5 million |

| 2017.8 | Series D | $100 million |

| 2018.10 | Series E | $300 million |

| 2018.12 | Strategic Investment | $21.3 million |

| 2021.4 | Listed on Nasdaq through Direct Public Offering (DPO) |

3 User Minds

Coinbase can be likened to the school’s disciplinary prefect, consistently adhering to regulatory protocols, placing a high emphasis on compliance and security matters, making it a model exemplary student. During leisure time, they have a passion for reading classics and steer clear of negative behaviors.

User Profile of Coinbase:

- Valuing Tradition: adopt a cautious approach towards risks, showing a preference for purchasing mainstream digital assets that have withstood market tests and demonstrate stability, ensuring relatively secure investments.

- Responsible: They approach tasks with earnest responsibility, demonstrating a strong sense of duty, striving to complete assignments punctually, and holding themselves accountable for their actions.

- Strong Moral Values: In their interpersonal interactions, they exhibit honesty and integrity, earning the respect and trust of others.

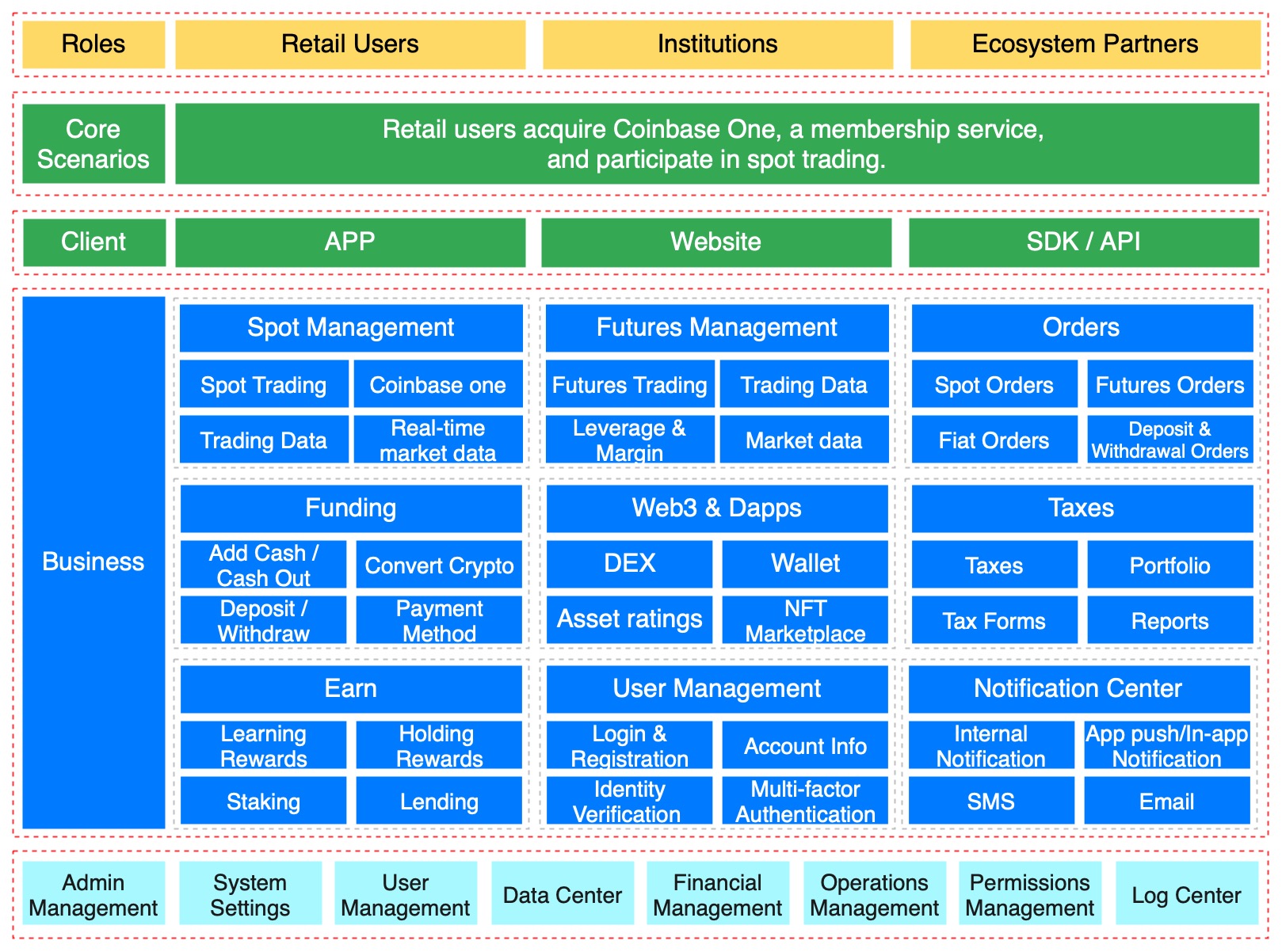

4 Product Architecture

5 Operational System

Balancing Trading and Services: Actively advancing diversified business endeavors, emphasizing the expansion of service domains, and reducing excessive reliance on trading fee revenue.

Strengthening Compliance for Business Growth: Always valuing compliance, ensuring a strong foundation for lasting and steady development.

Data Source:Prospectus

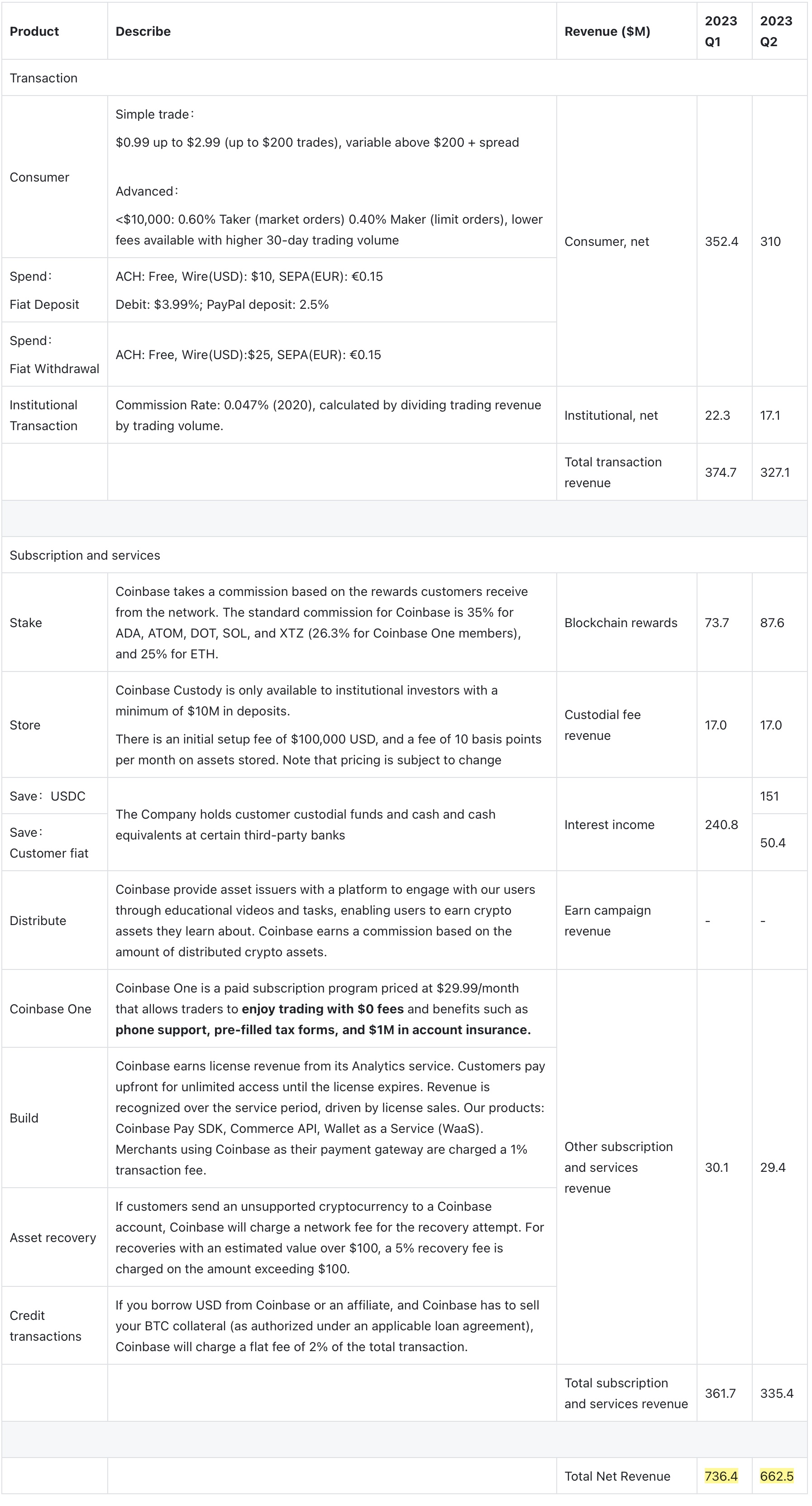

6 Business Model

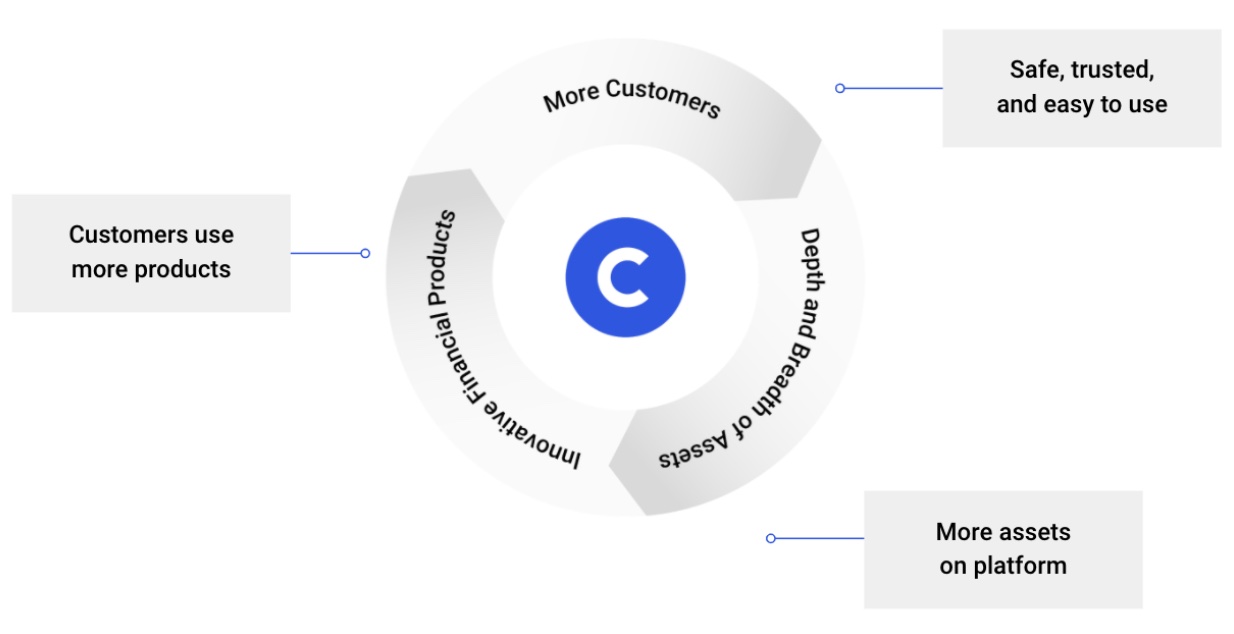

6.1 Business flywheel

Centered around trading and complemented by services, a virtuous cycle emerges among assets, products, and customers.

Data Source:Prospectus

Retail users and institutions opt for Coinbase as their entryway into the world of cryptocurrencies. Coinbase distinguishes itself with its emphasis on safety, reliability, and user-friendliness. Expanding the roster of supported crypto assets leads to heightened transaction activity and assets on the platform, boosting liquidity and attracting more retail users and institutions.

Harnessing its extensive reach, Coinbase empowers ecosystem partners such as asset issuers, merchants, and app developers to link up with millions of participants in the global cryptoeconomy.

As customer engagement flourishes, Coinbase’s understanding of individual needs deepens, facilitating strategic design, development, and launch of fresh, inventive products.

These offerings augment Coinbase’s value, drawing a wider customer base and propelling transactions, assets, and liquidity in a mutually advantageous cycle.

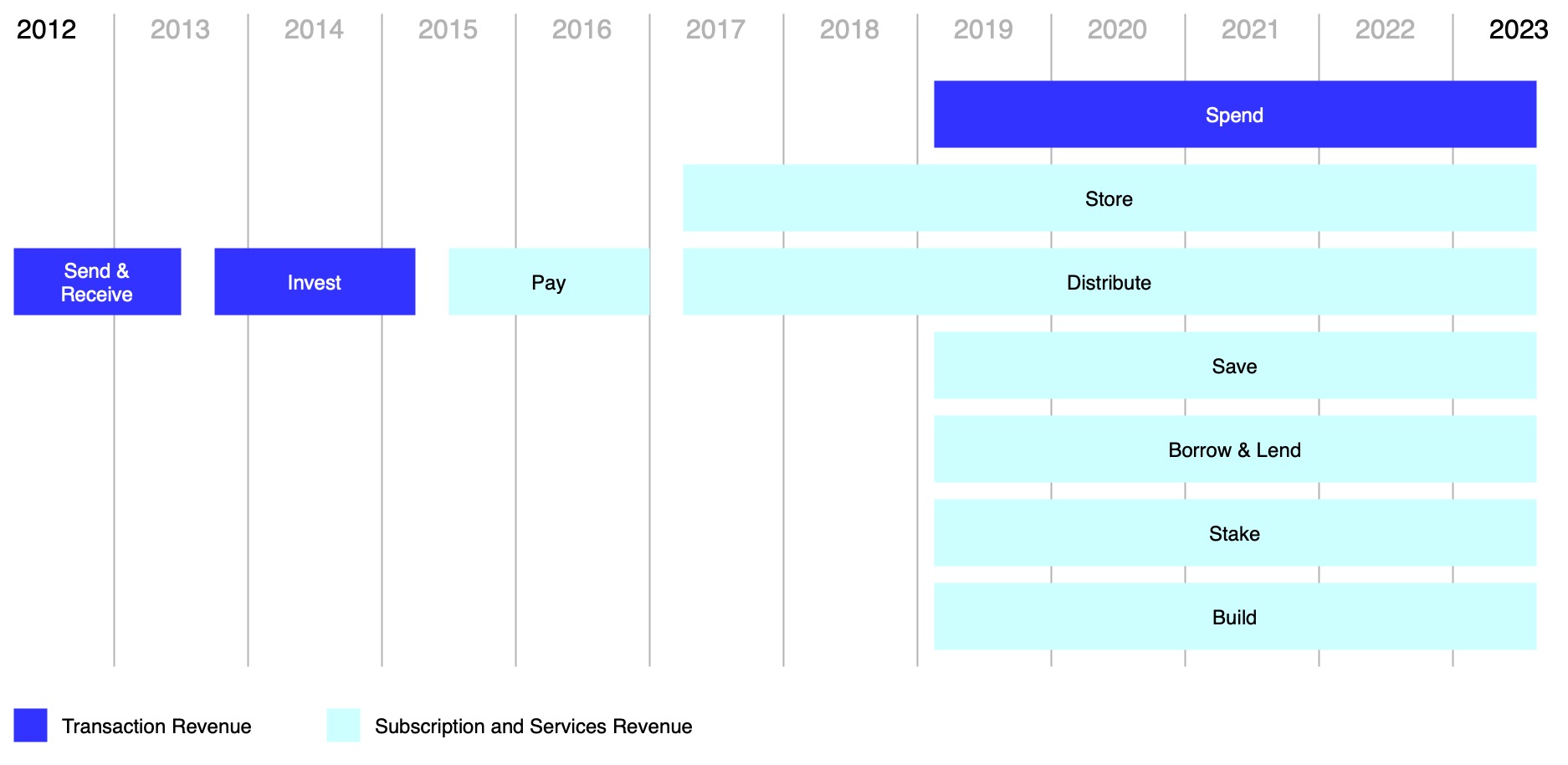

6.2 Coinbase Product Portfolio Overview

Data Source:Prospectus;Zhongtai Securities

6.3 Subscription and services: A Paradigm Shift

In the second quarter of 2023, revenue from subscriptions and services surpassed that from trading fees, challenging the traditional perception that exchange fees are the primary revenue driver.

Income mainly from interest. Coinbase earns interest by storing customer funds in third-party banks, with over 75% of income from USDC, benefiting from Coinbase’s relationship with Circle and Centre, the consortium that manages USD Coin. As a founding member of that consortium, Coinbase established a revenue-sharing agreement with Circle when USDC launched in 2018.

Moreover, Coinbase’s stablecoin business is experiencing steady growth. USDC tokens are pegged to the price of a sovereign currency and are typically backed by cash and government notes. As the Federal Reserve raises interest rates, the increase in yields from government bonds allows Coinbase to generate more interest income. This helps mitigate the impact of the declining USDC market value on the company’s interest earnings.

Data Source:Shareholder Letter

7 Distinctive Features

7.1 Sky-High Transaction Fees

The transaction fees on Coinbase are comparatively higher than Binance and OKX.

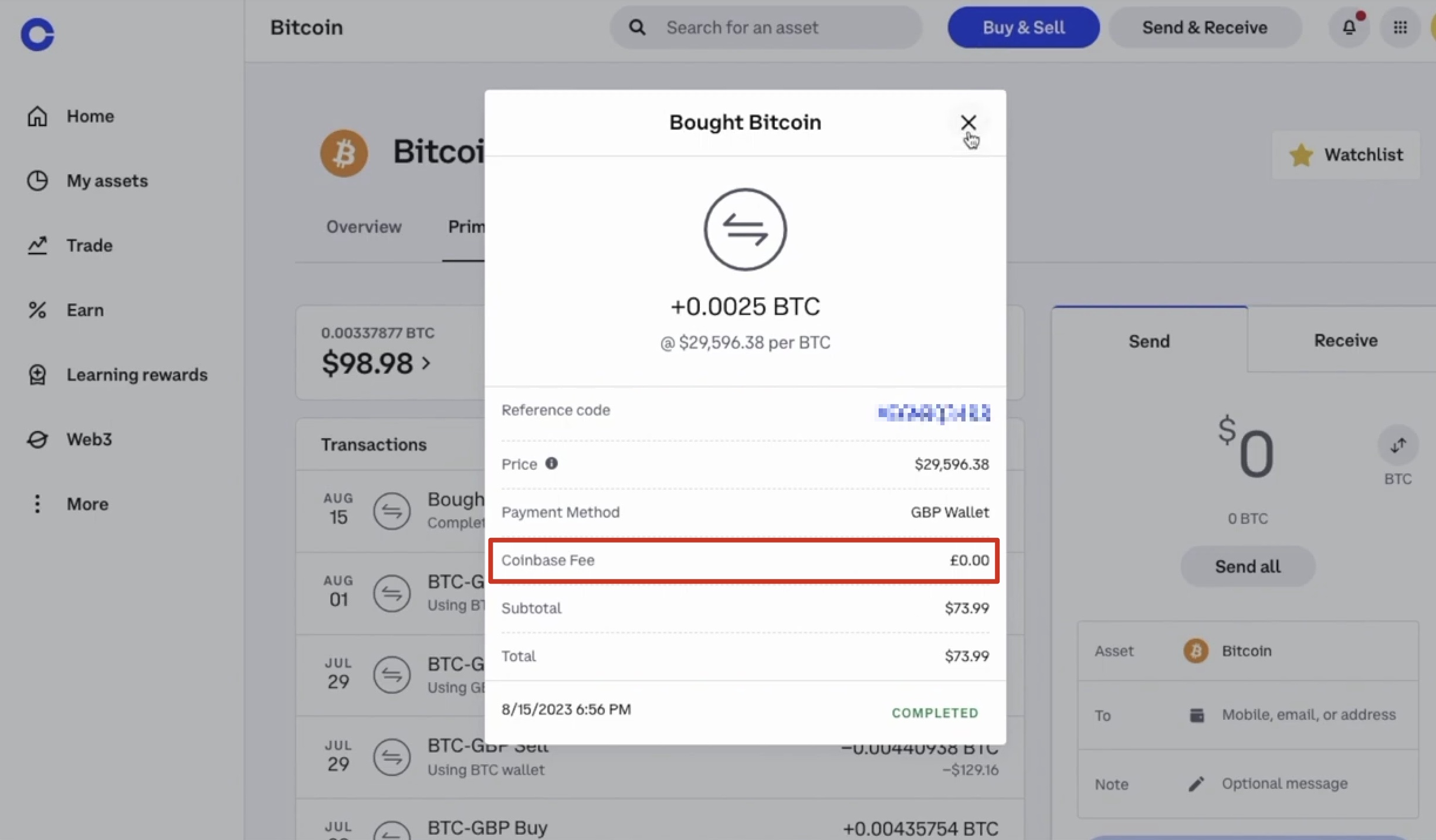

Trading is categorized into two types: Simple and Advanced.

In Simple trading, there is no order book. It’s akin to instantaneous P2P transactions.

When purchasing cryptocurrencies, set up your payment method, choose the coin, input the quantity, click buy, and complete the payment to ensure a successful purchase.

For selling cryptocurrencies, input the fiat currency amount, and the system will calculate the corresponding coin quantity based on the real-time coin price. Click sell to proceed.

For orders below $200, a fixed transaction fee is applied, ranging from $0.99 to $2.99.

| Purchase Amount (USD) | Coinbase Transaction Fees |

|---|---|

| (0,10] | $0.99 |

| (10,25] | $1.49 |

| (25,50] | $1.99 |

| (50,200] | $2.99 |

| 200 以上 | 1.49% - 3.99% |

For orders above $200, a fiat transaction fee of 1.49% to 3.99% is charged based on the chosen payment channel.

Coinbase spot trading fees max at 2% of total transaction. Fees decrease with higher volume, e.g., no extra charge for trading orders over $50M traded in 30 days.

| Payment Method for Purchase/Payout Method for Sale | Effective Rate of Conversion Fee (after waiver) |

|---|---|

| US Bank Account | 1.49% |

| Coinbase USD Wallet | 1.49% |

| Debit Card Buy | 3.99% |

| Instant Card Withdrawal | up to 1.5% of any transaction and a minimum fee of $0.55 |

| 200 以上 | 1.49% - 3.99% |

When previewing and placing orders, Coinbase includes a spread in the quoted price. This spread, commonly used by exchanges, also affects the exchange rate when converting between cryptocurrencies. Quoted prices or rates are shown on the trade preview screen before submitting your transaction. This practice enhances successful transactions and lets Coinbase temporarily lock in the quoted price during processing.

Spread increases the likelihood a transaction succeeds and allows Coinbase to temporarily lock in your quoted price while your order is processed.

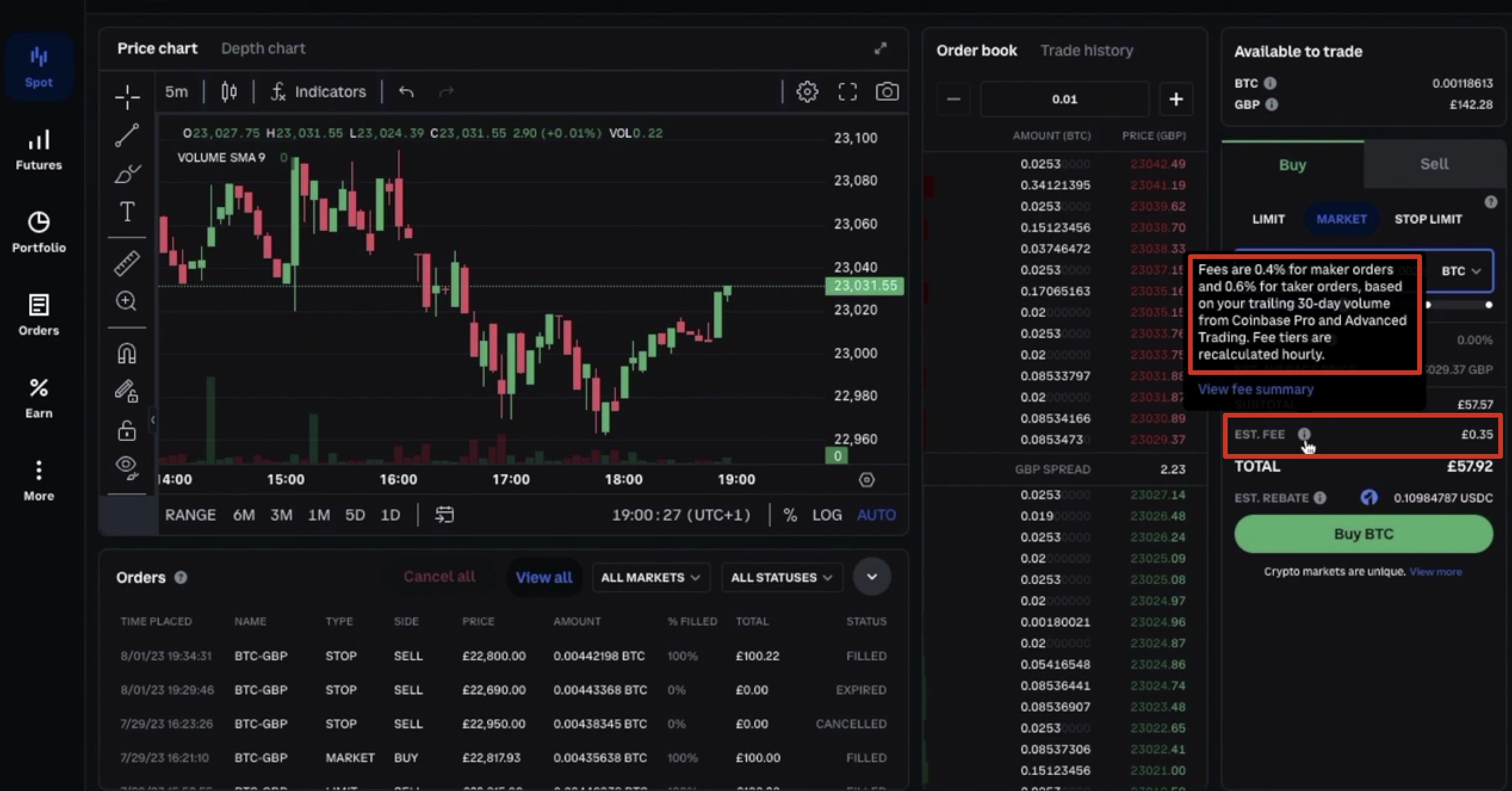

In 2022, Coinbase had a separate exchange called Coinbase Pro, now replaced by Coinbase Advanced.

To cut trading costs on Coinbase, consider using Coinbase Advanced, which doesn’t use a spread and offers much lower fees.

| Pricing tier | Taker fee (market orders) | Maker fee (limit orders) |

|---|---|---|

| <$10k | 0.60% | 0.40% |

| $10k - $50k | 0.40% | 0.25% |

| $50k - $100k | 0.25% | 0.15% |

| $100k - $1m | 0.20% | 0.10% |

| $1m - $15m | 0.18% | 0.08% |

| $15m - $75m | 0.16% | 0.06% |

| $75m - $250m | 0.12% | 0.03% |

| $250m - $400m | 0.08% | 0.00% |

| $400m+ | 0.05% | 0.00% |

For instance, buying $1000 of BTC via a US bank account incurs a $14.9 fee in the standard version. However, with professional trading and a limit order, the fee drops to just $4 – a notable 3.7 times difference!

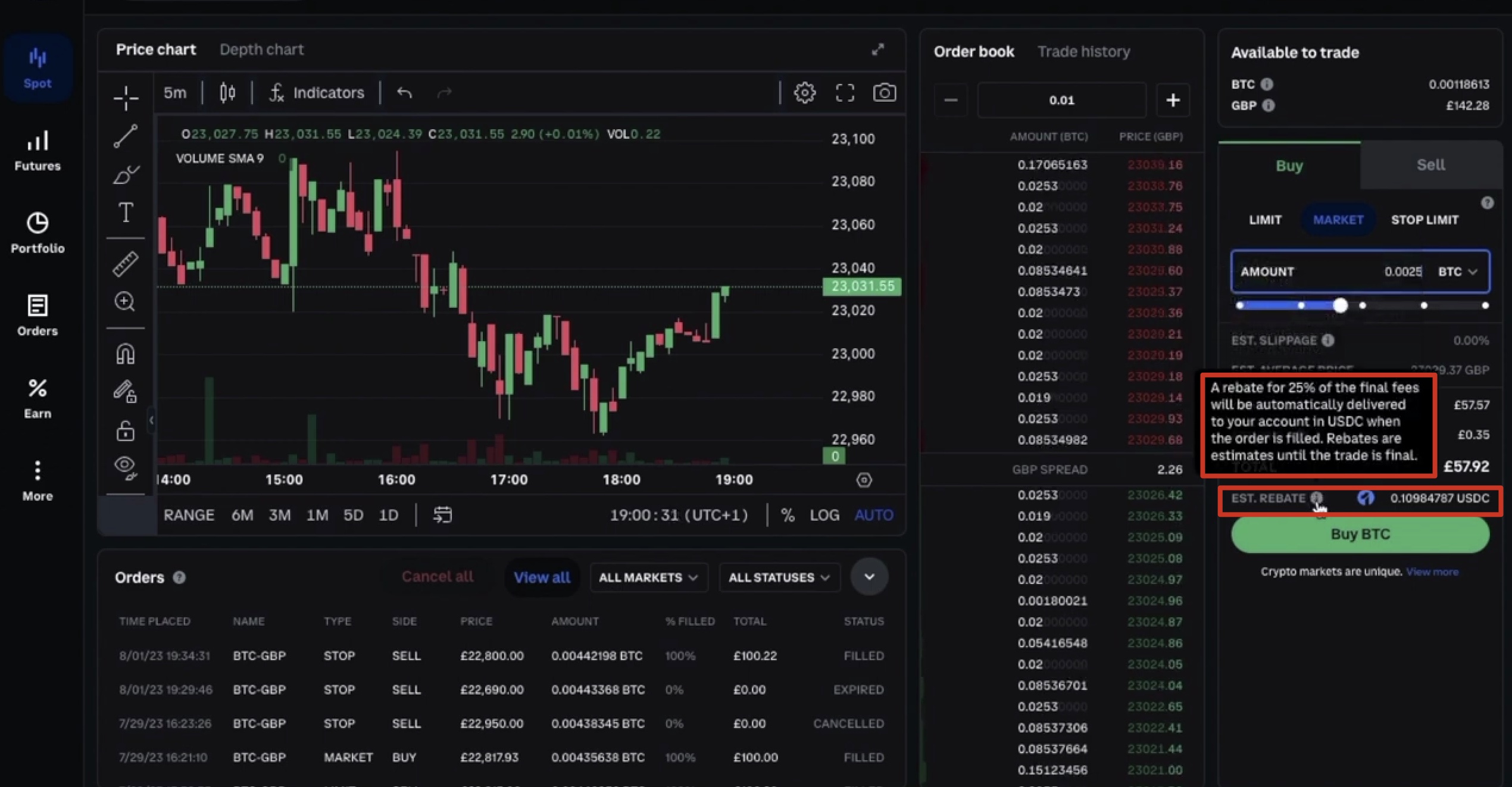

Although Coinbase Advanced is the most cost-effective way to trade, newcomers often prefer simple trade. For such users, Coinbase One subscription can save on fees.

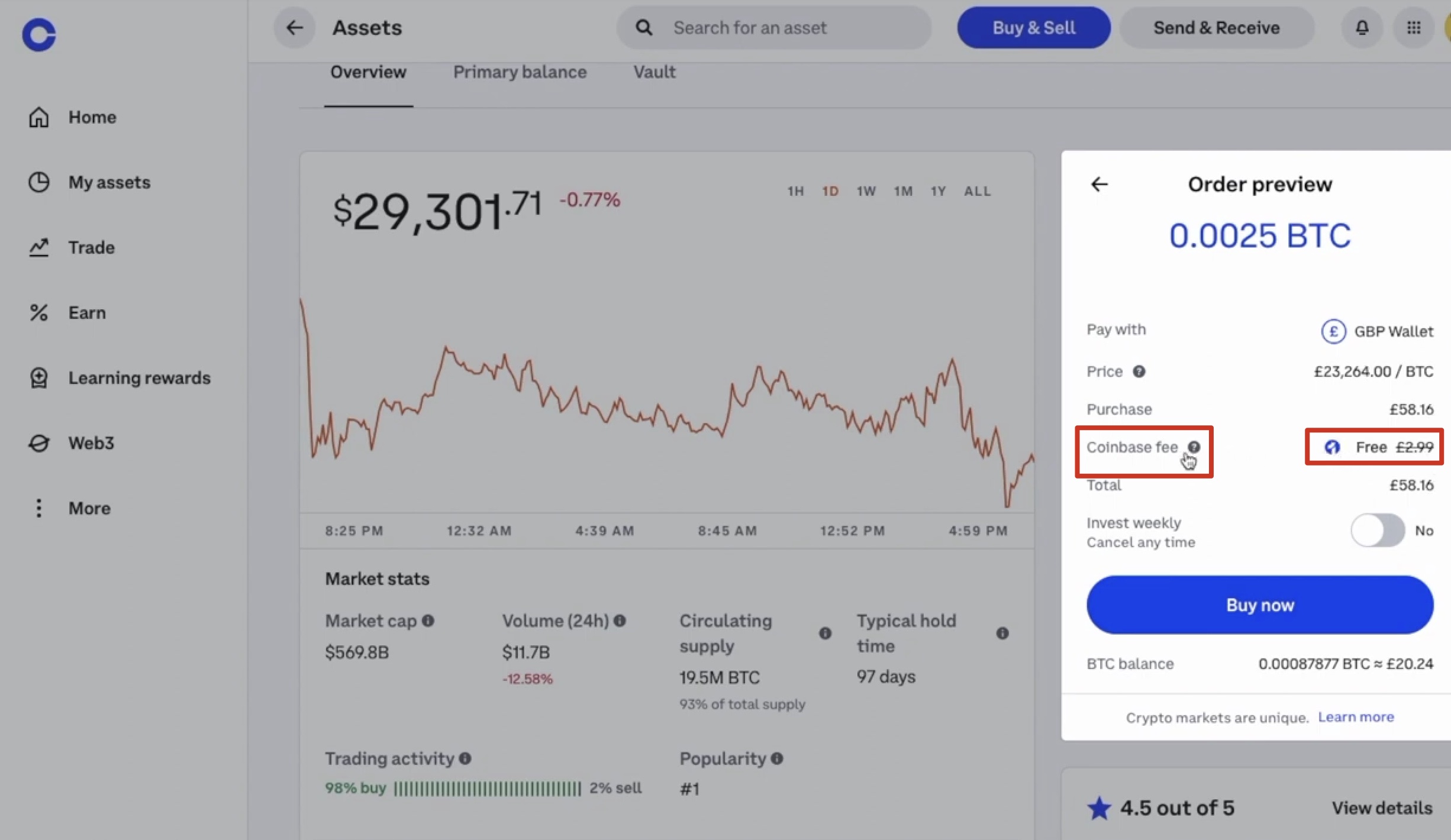

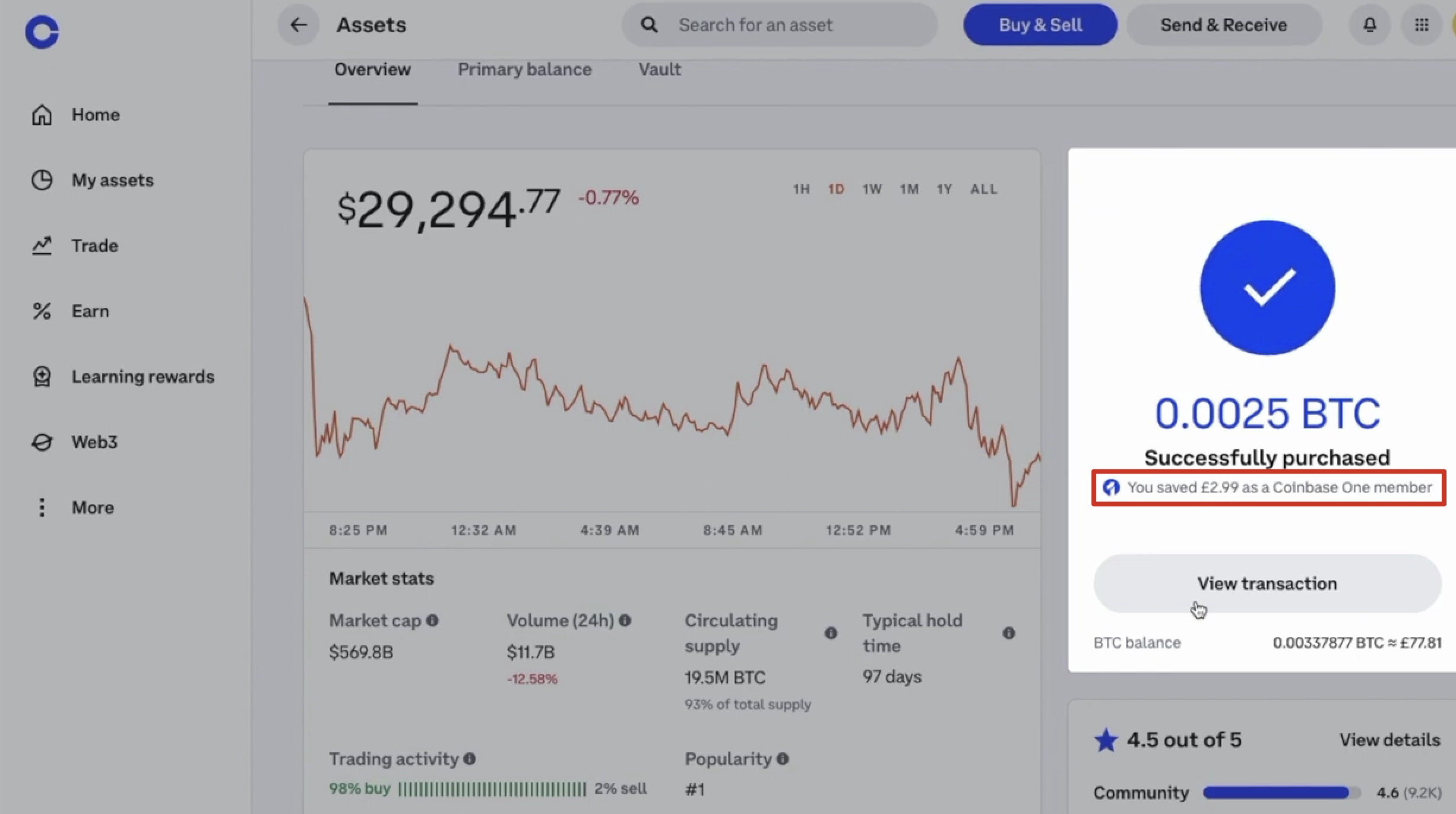

7.2 Fee-Reducing Subscription Solutions

Unlike Binance and OKX, which categorize users based on assets for VIP tiers with fee discounts, Coinbase introduces a unique solution—Coinbase One—to lower trading fees.

Coinbase One, a monthly membership service, offers a 30-day free trial for newcomers and is priced at $29.99 per month.

Experience fee-free trading:

By subscribing to Coinbase One, users utilizing the simple trade option enjoy fee waivers for transactions within a $10,000 monthly trading limit.

For advanced trading, fee exemptions do not apply, and fees remain tiered according to transaction amounts.

25% of these fees are refunded as rebates, automatically converted to USDC and deposited into accounts.

Beyond fee reductions, Coinbase One grants additional privileges to enhance users’ cryptocurrency trading experiences.

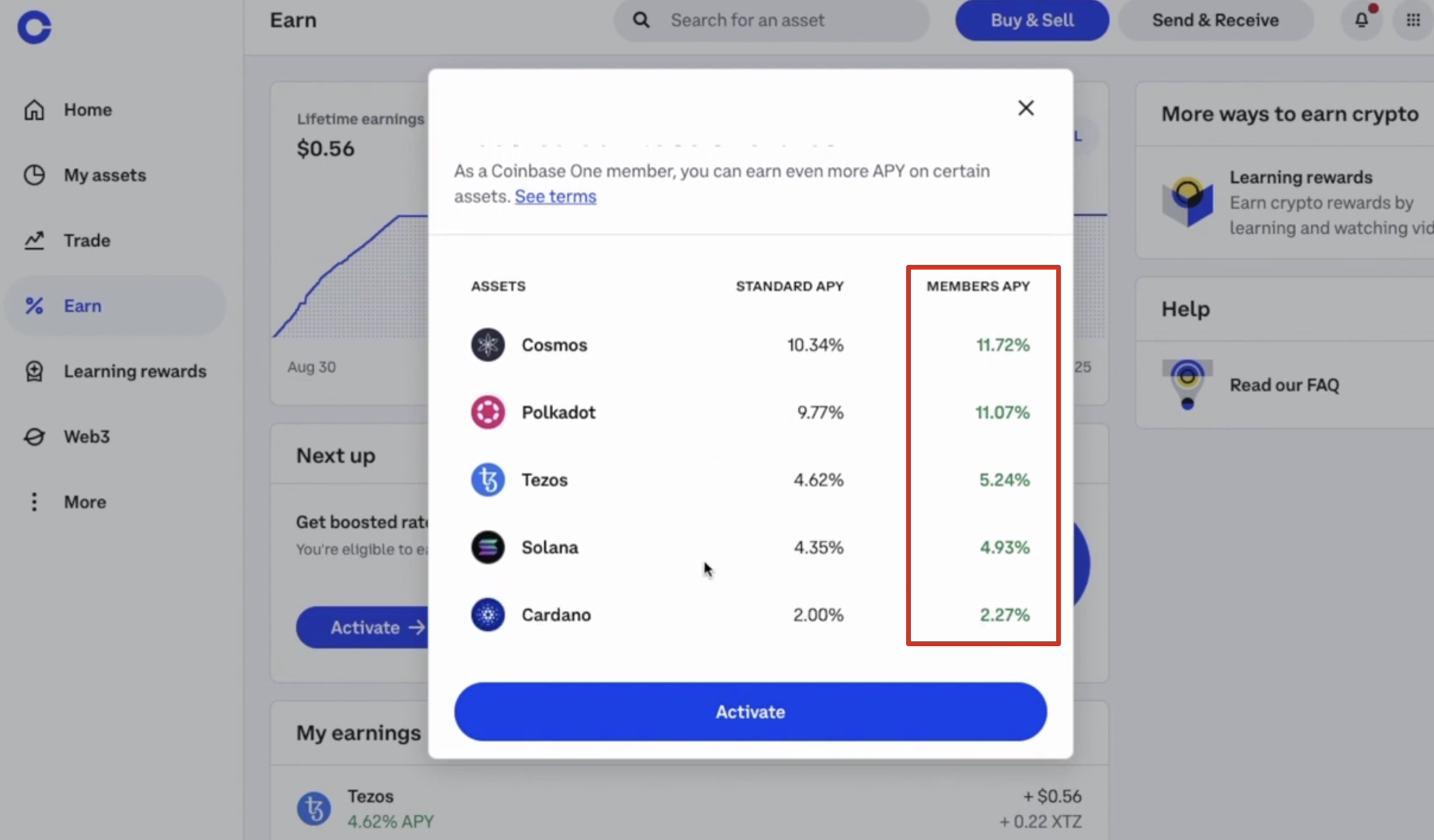

Enhanced POS staking rewards:

Coinbase One members earn heightened rewards when staking assets like ADA, ATOM, SOL, and XTZ.

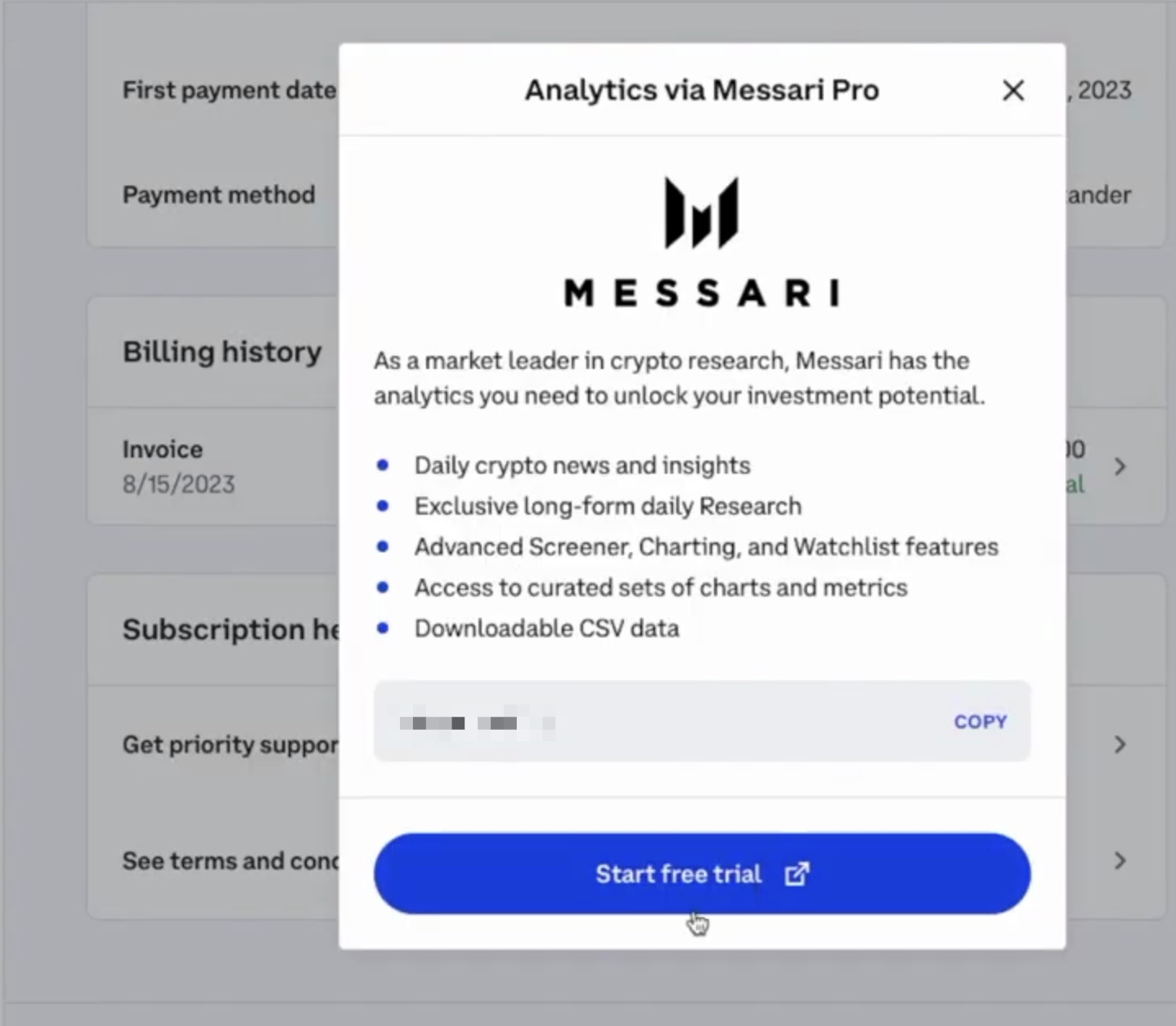

Partner discounts:

Coinbase plans partnerships to offer privileges like discounts and exclusive offers, encompassing crypto market analysis tools and more. A notable partner is Messari, a leading blockchain data analytics firm.

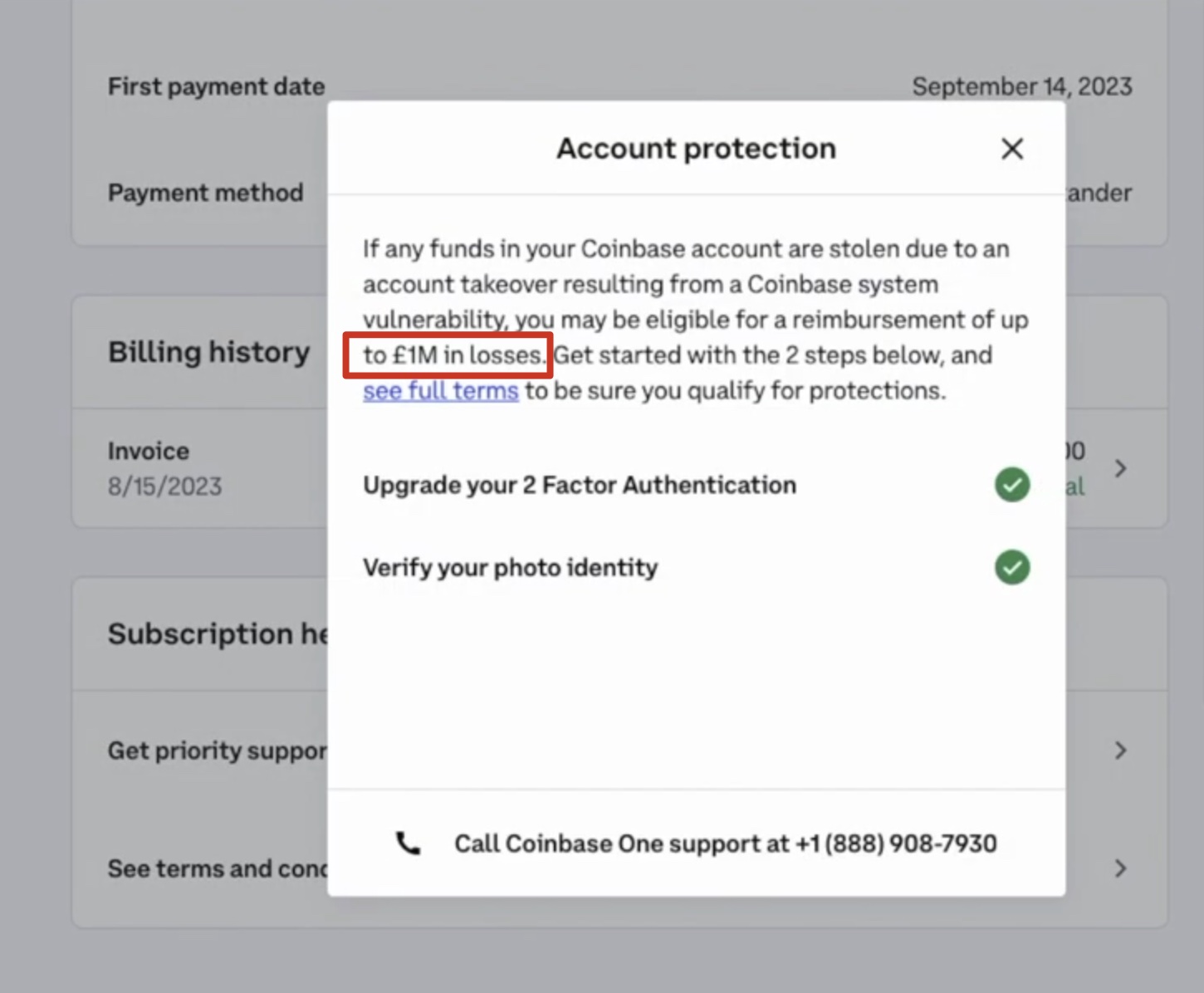

$1M account protection:

Users may be eligible for up to $1 million reimbursement if any funds in their Coinbase account are stolen due to an account takeover caused by a Coinbase system vulnerability.

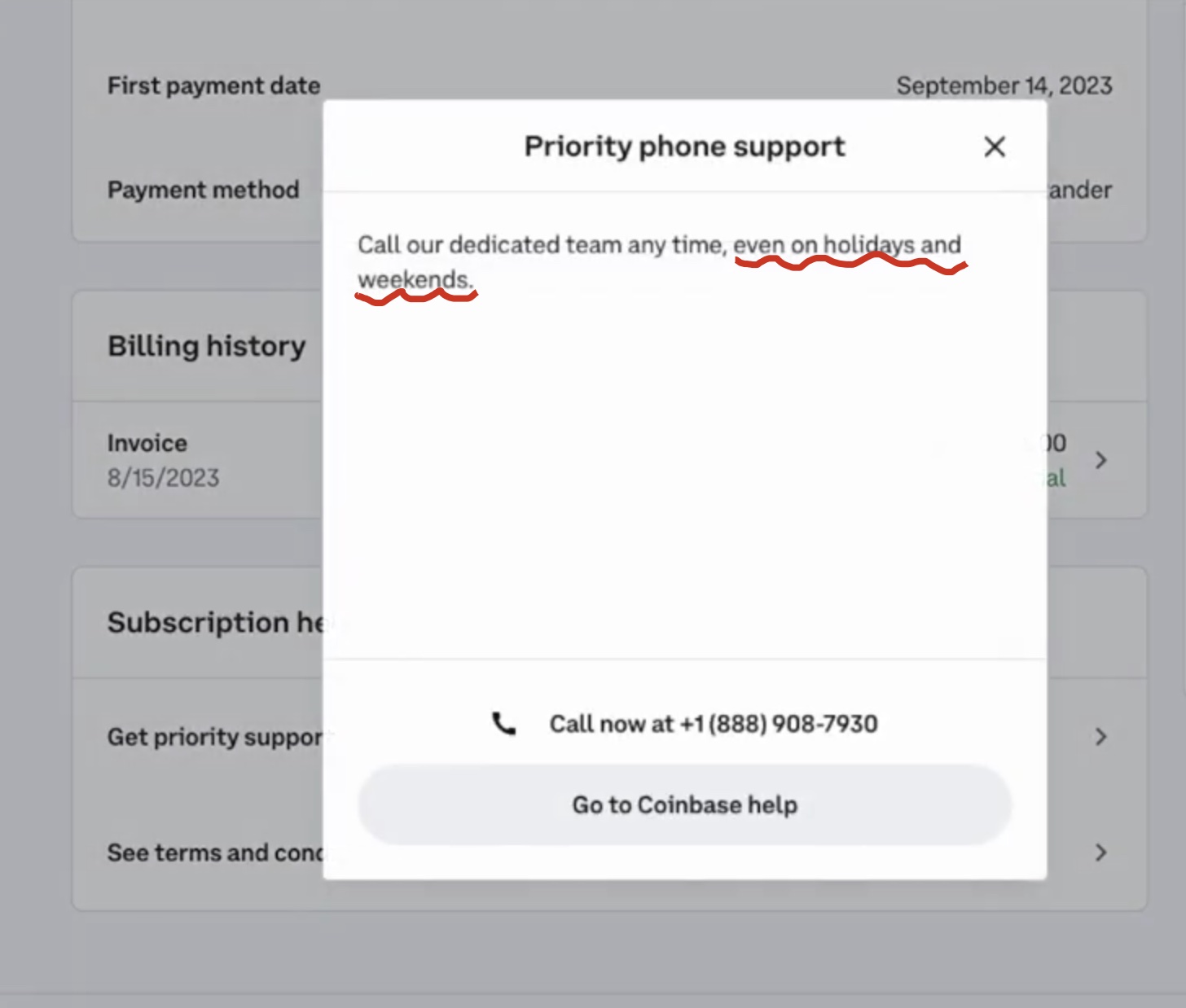

24/7 dedicated phone support:

Members have exclusive access to round-the-clock phone support, ensuring immediate assistance for account inquiries and technical concerns.

Pre-filled Form 8949:

Coinbase One members can generate IRS Form 8949 with pre-filled details, streamlining the tax reporting process by automatically organizing and submitting transaction data.

8 Summary and Insights

- Strong Compliance: The registration process rigorously verifies IP region, phone number, identity, and social security details. These strict checks ensure successful registration only for users meeting these criteria, enhancing security and regulatory compliance.

- Innovative Business Model: Coinbase ingeniously combines subscriptions and trading, providing users a unique way to reduce costs. With Coinbase One, a membership service, users can avoid trading fees and gain up to $1 million in account insurance. This strategy boosts revenue diversification for Coinbase.

- Coinbase conducts weekly updates to consistently improve user experience, focusing on performance enhancements and security fixes. Version numbers change more frequently than the update dates. Following an agile development approach, the team introduces incremental improvements and fixes, ensuring rapid response to market needs and competitiveness.

觉得文章不错就支持一下呗~

本文版权归 June 所有,采用 CC BY-NC-ND 4.0 国际许可协议 授权。

非商业转载请注明作者及原文链接,禁止改编及用于商业用途,商业合作请联系:yula.qian@gmail.com